[ad_1]

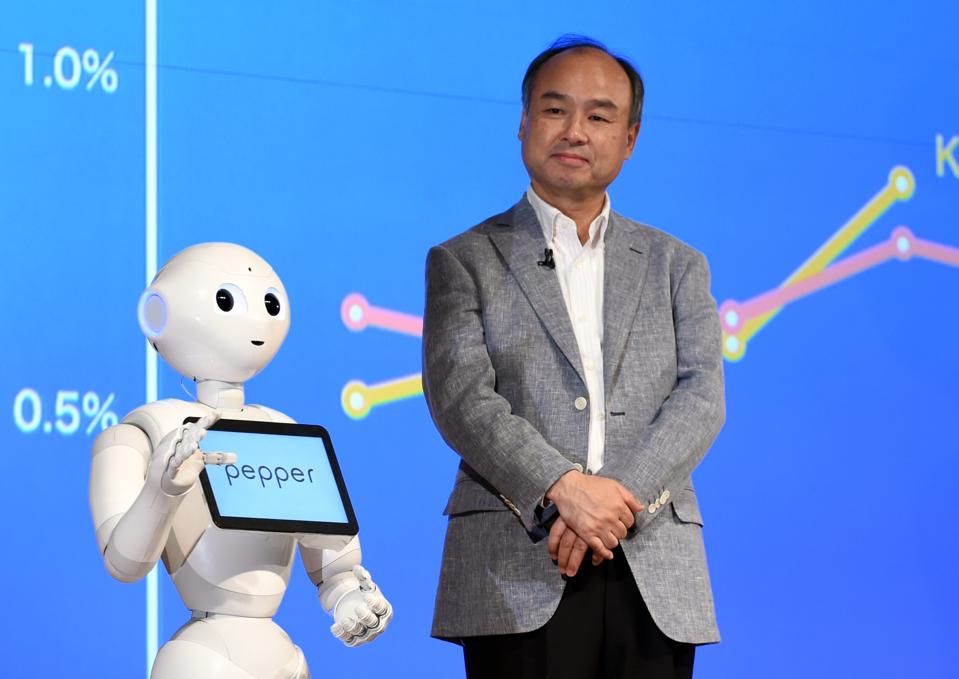

SoftBank Group founder and CEO Masayoshi Son looks at the company’s robot “Pepper” during a press … [+]

Japanese telecom and investment giant SoftBank is upping its bet on e-commerce and robotics with another big investment.

The Tokyo-based firm is investing $2.8 billion for a 40% stake in AutoStore, a Norwegian company that specializes in warehouse automation technology designed to support e-commerce operations. AutoStore said in a statement last week that the investment values the company a $7.7 billion and “accelerates AutoStore’s global expansion, with particular emphasis on the Asia-Pacific region.”

E-commerce itself is growing, which analysts see as a prime reason for SoftBank’s investment.

“We view AutoStore as a foundational technology that enables rapid and cost-effective logistics for companies around the globe,” SoftBank’s founder Masayoshi Son said in the statement.

The global e-commerce market of $9.09 trillion in 2019 should expand at a compound annual growth rate of 14.7% from 2020 to 2027, analysis firm Grand View Research forecasts. A boom in online shopping among people spending more time at their homes now because of the pandemic is fueling growth, says Sandy Shen, senior director with the digital commerce team of market research firm Gartner.

E-commerce sales jumped 27% year-on-year in 2020 due to pandemic lockdowns in many nations worldwide, says Rajiv Biswas, Asia-Pacific chief economist with market research firm IHS Markit. Before the pandemic, he says, e-commerce sales had already grown “rapidly” in largest economies with the proliferation of smartphones and e-payment systems.

SoftBank wants its portfolio companies to work together on creating their own ecosystem. The group manages tech firms such as Sprint and Yahoo Japan as well as the Vision Fund, the world’s largest tech-focused venture capital source. Vision Fund-backed companies in particular would form an ecosystem, in turn stoking overall portfolio growth, consulting firm Global Tech Partners says.

Vision Fund-invested e-commerce giant Coupang stands out as a likely ecosystem contributor. The South Korean firm’s initial public offering in New York last month was the largest U.S. IPO by a foreign company since 2014. Coupang had raised $2 billion from the Vision Fund in 2018 and represents access to a ripening market.

While China is saturated, Shen says, “in other parts of the Asia Pacific and in Europe, the scale of e-commerce isn’t as big, so there’s a chance for it to grow.”

“With the pandemic out there, that chance is all the higher,” she adds.

Automation and other supporting technologies will grow in sync with e-commerce itself, Biswas forecasts. AutoStore says it has a global “blue-chip” customer base with 20,000 robots in 35 countries. “As the share of the global retail e-commerce market continues to increase, the investment in new e-commerce technologies will continue to intensify, in turn helping to drive further growth in online shopping,” Biswas says.

[ad_2]