[ad_1]

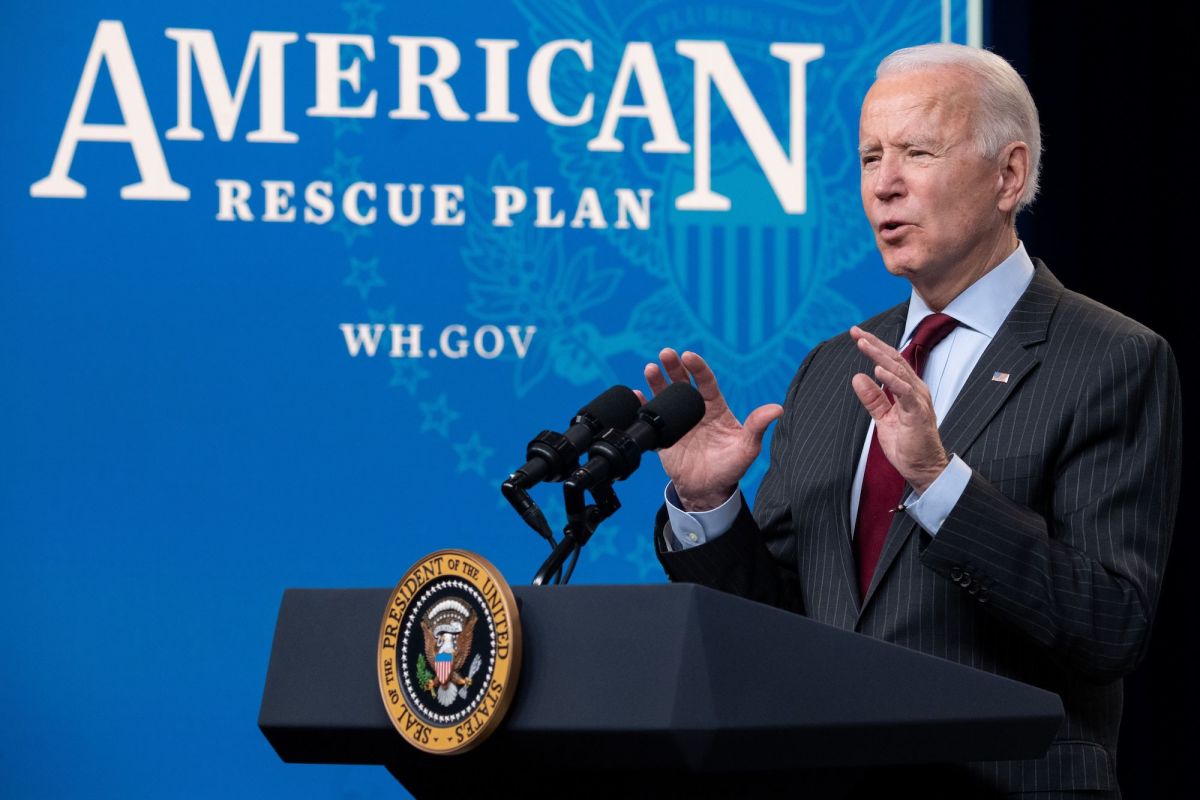

As you are probably well aware, a $1.9 trillion coronavirus relief package, known as the American Rescue Plan, aims to help individuals and families throughout the country as well as state and local governments. It’s chock full of financial lifesavers such as a stimulus check, enhanced unemployment benefits and a child tax credit.

But how much will you be getting? And what else is in this COVID-19 relief package that might help your cash flow? The answers to those questions follow.

How Much Are the Stimulus Checks?

Americans will be receiving $1,400 stimulus checks.

More specifically, if you’re single, you will receive $1,400, probably in your bank account but possibly through the mail. If you’re married and file jointly, your household will receive $2,800. If you have dependents, you’ll also receive $1,400 per dependent.

It’s also worth noting that during the last two rounds of stimulus checks, if you had a dependent older than 17, you didn’t receive any compensation for that person. This time around, it’s different: If you have an adult dependent, like a college student or an aging parent who you care for, you will receive $1,400.

Will Every Taxpayer Receive a $1,400 Stimulus Check?

Alas, no. If you’re a single taxpayer, and your adjusted gross income is below $75,000, you will receive a full $1,400 check. If your income is a little higher, you will still receive a stimulus check, but not the full $1,400. If you’re making $80,000 or more, though, you won’t receive a stimulus check.

If you’re a married couple filing jointly and making an adjusted gross income of below $150,000, you’ll receive the full $2,800 (two $1,400 checks). If you make a little more, up to $160,000, you’ll receive some money but not the full $2,800. If you have children, you’ll receive $1,400 per dependent. So a family of four – two adults and two children – would receive $5,600.

But what if you aren’t single or part of a married couple? What if you’re a single parent?

In that case, you should be filing taxes as a “head of a household,” and you can earn up to $112,500 annually and receive a stimulus check. So if you make $112,500 or less, you will receive a $1,400 check for you and $1,400 for each additional dependent. If you earn a little above that, up to $120,000, you would receive some of the stimulus check but not the entire amount.

It has been said that Americans should start receiving their stimulus checks before the end of March.

If I Am Unemployed, Will I Continue Receiving Enhanced Benefits?

Yes. You will receive $300 a week, on top of your normal unemployment check. Initially checks were to be $400 a week, but when the bill reached the Senate, after a lot of dickering, it was decided to keep the enhanced benefits at $300 a week (until Sept. 6).

That’s probably disappointing news, but on the plus side, federal income taxes for the first $10,200 of unemployment benefits that you received in 2020 (provided your household earns under $150,000 a year) will be waived. Because, yes, taxpayers pay taxes on unemployment benefits.

Meanwhile, the unemployment benefits ultimately help everyone, even if you aren’t unemployed, says Yeva Nersisyan, an associate professor of economics at Franklin & Marshall College in Lancaster, Pennsylvania.

“By providing aid to the unemployed we are not only helping these individuals and households, but we are also keeping spending and incomes in the economy higher than they would otherwise be. Without government aid, unemployed workers would have to cut their spending, which would lead to lower incomes for others,” Nersisyan says, citing an example that if she stops buying coffee from her local coffee shop, that coffee shop owner will have less income.

“This all stems from the simple macroeconomic principle that someone’s spending is someone else’s income. When spending goes down, so does income,” she says.

Is There a Child Tax Credit?

Yes. The child tax credit has been expanded. Right now, if you have a child under 17, the child tax credit is worth up to $2,000, and you receive it after filing your taxes. But parents of children age 6 and under will start receiving $300 monthly payments via direct deposit or through the mail starting around July, and parents with kids ages 7 to 17 will receive $250 a month – and then claim the rest of the year’s tax credit when they file 2021 taxes.

Ahmed Rahman, an associate professor economics at Lehigh University in Bethlehem, Pennsylvania, says the new tax credit is a big deal.

“Research has demonstrated that direct payments to parents improve children’s education, health and career outcomes. Money to those with children should be thus considered an investment, not a handout,” Rahman says. “Payments under the current proposal are tied to the number of children rather than the level of income. Such cash payments would bring the U.S.’s economic support for families more in line with developed countries. We still lack other kinds of support, such as wide availability of child support or company-sponsored family leave, typical of the developed world. But this would be a good start.”

Does the COVID-19 Relief Package Affect Health Insurance?

The relief bill will increase government subsidies to health insurers, allowing insurance companies to cut rates for insurance premiums so that your health insurance premiums aren’t higher than 8.5% of your income.

In other words, people who don’t have health insurance through employer-sponsored health insurance or a government plan, like Medicare or Medicaid, should consider shopping around for a new policy during the new Affordable Care Act enrollment period, which will go until mid-May.

Also, if you’ve lost your job and want to keep the health insurance coverage you had through your former employer, tax credit subsidies will help pay your premiums through the federal insurance program, COBRA, through Sept. 30.

Does the COVID-19 Relief Package Affect Student Loans?

It does, though not in a way you’ll immediately notice. There’s a provision in the package that exempts student loan forgiveness from taxes that might help people avoid large tax bills if their debt is forgiven down the road.

So if you have student loan debt, you still have it. But, during his campaign, President Joe Biden pledged to forgive up to $10,000 in student loan debt, per individual, and if he does that through an executive action in the future, this provision prevents people from being hammered by a tax bill.

Some Congressional Democrats have argued, meanwhile, for $50,000 in forgiveness on student debt. So down the road, families may see forgiveness of student debt between $10,000 and $50,000.

That would be a huge boost to everyone’s wallets, whether they have student debt or not, according to Nersisyan. “Many college grads are drowning in debt, which drags the economy down,” she says. “Student loan forgiveness would be a big boost to the economy and would improve the living standards of many Americans, especially if we forgive up to $50,000 of debt.”

[ad_2]